Questions and answers

Questions and answers

Here you can find frequently asked questions (and answers) about housing benefit. You can also contact us during office hours at 440-6400, or by online chat or by sending an e-mail to hms[at]hms.is.

Entitlement to housing benefit

Housing benefit is a system of monthly payments designed to help those who rent their homes, whether this is done within the socially-assisted housing system, in student residences or on the open rental market. The aim of the Housing Benefit Act is to reduce lower-income tenants’ housing costs in connection with the rental of residential premises. When housing benefit entitlements are calculated, the income and assets of all members of the household aged 18 an over are taken into account, and also the amount being paid in rent and the number of people in the household in the rental premises in question.

Applicants must be aged 18 or over.

- Individuals aged under 18 may apply for housing support from their local authorities (municipalities).

Applicants must be living in the relevant premises and have their domicile there.

Exemptions from the residence requirement:

Notwithstanding the condition regarding residence, individuals may qualify for housing benefit even if their registered domicile is elsewhere in Iceland if they are temporarily resident in the premises in connection with:

- studies – Confirmation of attendance of an educational institution must be submitted.

- illness or the use of health services – A medical certificate confirming this must be submitted.

- residence in a half-way house – Confirmation from the half-way house of the applicant’s temporary residence there must be submitted.

- temporary employment far from the applicant’s domicile – An employment contract confirming this must be submitted.

Applicants must be parties to a rent agreement valid to at least three months. Rent agreements have to be registered electronically with HMS, see here for further details www.hms.is/leiguskra

Exemptions from registration of rental agreements:

- Tímabundin afnot búseturéttarhafa skv. 15.mgr. 20.gr. laga um húsnæðissamvinnufélög, nr. 66/2003

- Gerðarþola skv. 6.tölul. 1.mgr. 28.gr. laga um nauðungarsölu nr. 90/1991

- Leigjanda skv. 11.tölul. 1.mgr. 29.gr.sömu laga af íbúðarhúsnæði sem hann hafði við nauðungarsölu til eigin nota, í allt að tólf mánuði gegn greiðslu samkvæmt ákvörðun sýslumanns

The residential premises must include at least one bedroom, a private cooking facility, a private toilet and a bathroom facility

Exemptions from the conditions regarding facilities in the premises:

Notwithstanding the conditions regarding residential premises, housing benefit may be paid in the case of:

- Communal pupils’ facilities in boarding schools or students’ residences.

- Communal housing solutions for disabled persons.

- Premises shared by persons in half-way houses.

Applicants and other household members aged 18 and over must grant authorisation for the gathering of information.

- Information gathered will include details of income and assets from the Directorate of Internal Revenue (tax authorities), details of domicile from the National Registry and information about leases from district commissioners and municipal authorities.

- Household members must open “My pages” using their own means of identification in order to grant authorisation. Authorisation may also be given using paper forms.

When they pass ISK 8,000,000, the total assets of all members of the household aged 18 and over begin to reduce housing benefit entitlement; when they reach ISK 12,800,000, housing benefit entitlement no longer applies. – The figure used here is the net asset position as stated on the persons’ tax returns, i.e., their assets less their liabilities.

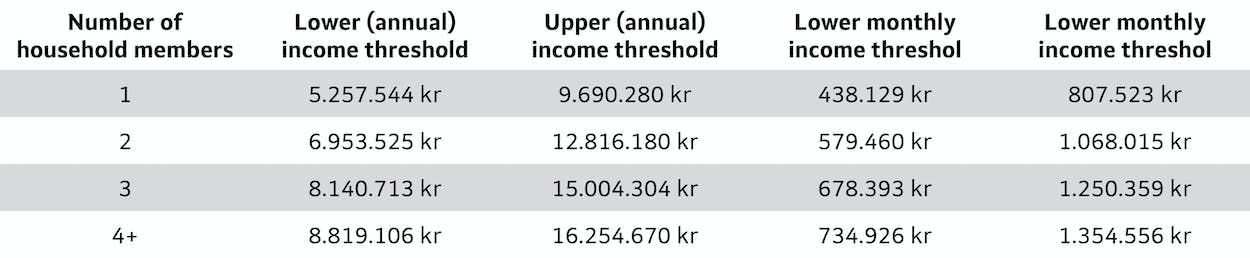

This table shows some of the key figures for reference purposes

- Based on the combined taxable income of all members of the household aged 18 and over, before tax

- If income is below the lower threshold, full benefit will be paid

- If income is above the upper threshold, no benefit entitlement will apply

- If income lies between the lower and upper thresholds, benefit will be reduced

- The reduction will be 11% of the amount exceeding the lower threshold

Enter your figures in the calculator here to obtain an estimate of the monthly payments

Number of household members: 1

- Maximum annual benefits: 487.601

- Maximum monthly benefits: 40.633

Number of household members: 2

- Maximum annual benefits: 644.892

- Maximum monthly benefits: 53.741

Number of household members: 3

- Maximum annual benefits: 754.995

- Maximum monthly benefits: 62.916

Number of household members: 4+

- Maximum annual benefits: 817.912

- Maximum monthly benefits: 68.159

- Benefit entitlements shown here are based on income under the lower income threshold, assets under the level at which they reduce entitlement and housing costs below 75% of basic benefit

- The basic housing benefit level is revised in each year’s national budget

- If the applicant, or other household members, are already registered in another application.

- If the rented premises are not registered in the Property Register as being intended for residence.

- Where parts of an apartment, or individual rooms, are rented out.

- If any of the household members qualifies for interest benefit.

- If any member of the household is the owner of the premises or owns a controlling share in a company that owns the premises in question.

- When housing benefit is already being paid in respect of the same residential premises.

Applying for housing benefit

- You send in an online application via “My pages” on the website of the Housing and Construction Authority.

- You will need to use electronic identification or the Íslykill to register.

- You can fill out an application on paper :

- At the office of the Housing and Construction Authority, Borgartúni 21, Reykjavík.

- Or print the form out here, fill it in an send it to us.

Housing benefit may not be paid retroactively for periods before the month in which your application is received, even though the rent agreement started earlier; it is therefore important that you submit your application as soon as possible.

Generally, there is no need to submit anything apart from your application and, as appropriate, authorisations from other household members. The Housing and Construction Authority may call for further materials if they are considered necessary to process your application.

- If further materials are needed, you will be contacted via “My pages” and the e-mail address you gave in your application.

- If you have requested not to have electronic communications with the authority, then a letter will be sent to your domicile address calling for further materials.

Rent agreements have to be registered electronically with HMS, see here for further details www.hms.is/leiguskra

- We recommend that you submit your application as soon as your rent period begins.

- You, as the applicant, must be registered as the tenant in the rent agreement; in other words, the lease may not be in the name (and ID No.) of another member of your household.

- Where the necessary materials (including the registered lease) have not reached us by the 20th day of the month, we cannot guarantee that your application will be processed before the end of the month. Where an application is approved following receipt of materials called for, benefit will be paid in the next scheduled round of payments.

- Those who are resident in the rental premises, and whose legal domicile is there, are to be named as household members on the application. This includes children.

- Parents who have their children living with them for a minimum of 30 days per year may register them as household members even though they are domiciled with the other parent.

- After reaching the age of 18, an individual may only be listed in one application.

- Household members aged 18 and over must grant the Housing and Construction Authority authorisation so that it can gather the information needed to process the application.

- Household members must open “My pages” using their own means of identification in order to grant authorisation after the applicant has submitted the application, listing the household members in it.

- Authorisation may also be granted using the printed form here.

Processing of applications

Applications are processed after the middle of the month in which they are submitted, providing that the rental period starts in that same month, or has already begun.

Examples:

An application is submitted on 15.05 and the rental period is to start on 01.06. The application will be processed after mid-June.

An application is submitted on 15.05; the rental period began on 01.05. The application will be processed after mid-May.

- If your application is submitted online, then all communication with you after that will be online (electronic).

- You will receive a notification sent to the e-mail address you give, stating that a letter is waiting for you at “My pages” with the outcome of your application.

- If you do not wish to have electronic correspondence with the authority, you can call the Service Desk at 440-6400.

- If your application has been submitted on paper, you will receive a letter, sent to your domicile address, with the outcome of your application.

- An application may be put on hold if further materials or information is needed to be able to process it.

- Applicants can see why their applications have been put on hold under “Communications” and “Documents” on “My pages”.

- When an application has been put on hold, the applicant must act on the reason given within 45 days; after that time, the Housing and Construction Authority may reject the application.

- If you consider you need more time to gather the materials that are needed, you can ask for a time extension by contacting hms@hms.is, sending an enquiry via “My pages” or by phoning 440-6400.

- Processing of your application, or disbursement of housing benefit payments, as appropriate, will be postponed until the requested materials have been received.

- If you do not receive a payment at the beginning of a month, it will be paid to you on the next scheduled payment date after your application is approved .

- If your application is put on hold and the materials that are called for are not received by the deadline set, or if the reason why your application was put on hold proves to be valid and you are not entitled to housing benefit, then your application will be rejected an no benefit payments will be made on the basis of it.

The registered rent agreement is missing

Rent agreements have to be registered electronically with HMS, see here for further details www.hms.is/leiguskra

Authorisation is needed from a household member

Household members aged 18 and over must approve the application, using their own identification methods, via “My pages” or else on paper; forms are available here or at the office of the Housing and Construction Authority.

The applicant, or a member of the household, is not registered as being domiciled at the premises

Registration of domicile at the National Registry can be changed here.

If there are insuperable obstacles that prevent the applicant from being able to change domicile, he or she shall submit explanations, with the appropriate materials, and apply for an exemption or a time extension by contacting hms@hms.is or by submitting a question via “My pages”.

Household members who are domiciled in the rental premises are not listed in the application

• All those who are resident in the rental premises and are domiciled there shall be listed in the application as household members.

• The applicant must register household members in the application via “My pages” at hms.is by clicking “Add household members” and saving the changes made.

• NB: household members aged 18 and over must then approve the application by logging in on “My pages” at hms.is, using their own means of identification.

Benefit entitlement has been reduced to zero by income and assets

• If you, the applicant, consider that your income estimate does not give a true and accurate picture of your income during the rental period, you must submit materials in support of this view, and your application will be reprocessed.

• If you, the applicant, consider that your assets or capital earnings, which have reduced your housing benefit entitlement, have changed since your last tax return was submitted, you must submit materials in support of this view so that your application can be reprocessed.

• If the information on your income and assets proves correct, then your application is being rejected because you are not entitled to receive housing benefit.

The premises do not meet the minimum requirements regarding residential facilities

• If you, the applicant, consider this is not correct, and can demonstrate that the premises actually contain at least one bedroom, a private toilet and bathroom facility and a private cooking facility, then you must submit materials in support of this view to hms@hms.is or through “Questions” on “My pages.”

- No housing benefit payments will be made in response to the application.

- If you, the applicant, do not act on the reason give for your application being put on hold by the stated deadline for responding, then the view will be taken that you are not entitled to housing benefit and your application will therefore be rejected.

Reasons for rejection could be (examples only):

- The materials called for when the application was put on hold have not been received 45 days later.

- Benefit is already being paid in respect of the same premises.

- The lease is for a term shorter than 3 months.

- The premises do not meet the minimum requirements regarding residential facilities.

- Household members’ income or assets reduce benefit entitlement to zero.

- A member of the household is the owner of the rental premises.

If you, as the applicant, consider that changes have taken place since your application was rejected, you may submit a new application.

- Then you will be entitled to receive housing benefit.

- Details on the full monthly amount of benefit payments will be stated in the letter announcing the approval on “My pages”.

- Benefit will be paid out in the next scheduled disbursement following approval; in no case will payment be made for a period going further back in time than the month in which your application is received, even if you have already been renting for longer.

NB that changes in the situation on which your housing benefit has been decided will have an impact on your entitlement. The Housing and Construction Authority may at any time recalculate your benefit entitlement to bring it into line with changes in your circumstances or those of other members of the household since your application was approved.

- No. Housing benefit may not be paid for a period going further back in time than the month in which your application is received, even if the lease took effect earlier. Entitlement to receive benefit payments is established in the month in which the application is received, providing that the conditions of the Housing Benefit Act, No. 75/2016, are met.

- Housing benefit may not be paid retroactively for periods before the month in which your application is received, even though the rent agreement started earlier; it is therefore important that you submit your application as soon as possible.

- It is not possible to guarantee that housing benefit will be paid out at the beginning of the month following the receipt of applications that are submitted after the 20th day of a month. Payment will be made in the next scheduled disbursement, providing that the application is approved.

- Yes, you may request a review of a decision on your entitlement to housing benefit if you consider that new information and/or materials are in existence which will demonstrate that the decision was taken on the basis of insufficient, or wrong, information, or has led to a conclusion that is materially incorrect.

- Requests for reviews should be sent to hms@hms.is, or submitted via “Questions” in “My pages.” You should mention, in your request, all materials that you believe will have an effect on the outcome of the review and send the relevant materials in support of your request. The matter will then be put before a committee for a further decision.

- Decisions on housing benefit may be referred to the Welfare Appeals Committee. The deadline for submitting complaints shall be three months from the date on which the decision was announced.

Calculation of housing benefit

The Housing and Construction Authority may at any time recalculate your benefit entitlement to bring it into line with changes in your circumstances or those of other members of the household since your application was approved.

Housing benefit calculations are based on the income and assets of all household members aged 18 and over, the rent amount and the number of persons resident in the rental premises in question.

- The Housing and Construction Authority is obliged by law to make an income and asset assessment on which the benefit calculation will be based.

- New assessments are made every three months.

- Calculations of housing benefit entitlements are to take account of income received during the rental period.

- All calculations are based on pre-tax earnings.

Number of household members: 1

- Maximum monthly benefit: 40.633

- Lower monthly income threshold: 438.129

- Upper monthly income threshold: 807.523

Number of household members: 2

- Maximum monthly benefit: 53.741

- Lower monthly income threshold: 579.460

- Upper monthly income threshold: 1.068.015

Number of household members: 3

- Maximum monthly benefit: 62.916

- Lower monthly income threshold: 678.393

- Upper monthly income threshold: 1.250.359

Number of household members: 4

- Maximum monthly benefit: 68.159

- Lower monthly income threshold: 734.926

- Upper monthly income threshold: 1.354.556

- The combined income of all members of the household aged 18 and over, before tax.

- If income is below the lower threshold, no reduction of benefit will be made due to income.

- If income is above the upper threshold, no benefit entitlement will apply

- The reduction due to income lying between the lower and upper thresholds will be 9% of the amount exceeding the lower threshold.

All taxable income of the members of the household is counted as income; this includes old-age and disability pension payments, payments from private pension savings, capital earnings, foreign earnings and various grants.

Grants are generally regarded as taxable income; there are, however, exceptions from this, which can be seen on the website of the Directorate of Internal Revenue here.

Vacation-pay supplement and December bonus payments count as taxable income.

When housing benefit applications are processed, information is retrieved from the Directorate of Internal Revenue’s register of tax deductions at source regarding taxable income; income that is classified as tax-free therefore does not affect the calculation.

Information on tax-free income can be found on the website of the Directorate of Internal Revenue, here.

All taxable income of the members of the household is counted as income; this includes old-age and disability pension payments, payments from private pension savings, capital earnings, foreign earnings and various grants.

Grants are generally regarded as taxable income; there are, however, exceptions from this, which can be seen on the website of the Directorate of Internal Revenue here.

Vacation-pay supplement and December bonus payments count as taxable income.

When housing benefit applications are processed, information is retrieved from the Directorate of Internal Revenue’s register of tax deductions at source regarding taxable income; income that is classified as tax-free therefore does not affect the calculation.

Information on tax-free income can be found on the website of the Directorate of Internal Revenue, here.